This resource provides helpful information on the impact of various relief funding programs on your taxes.

How Does Relief Funding Affect Your Taxes?

Both the state of Wisconsin and the United States federal government dedicated many resources to support child care programs through the COVID-19 pandemic. Relief funding saved many businesses from permanent closure — perhaps even your own.

While these relief funds were highly needed and well-used, many child care business owners have wondered how this funding will affect their taxes. Different relief funding programs will have varying impacts on your federal and state taxes because funding sources are governed by different tax laws.

Also, Wisconsin has set some regulations on how to file your state taxes, which differ from the federal standard.

After reading this guide, you will be able to:

Recognize key relief programs and their general tax implications,

Identify the general impacts of relief programs on tax filings, and

Use this information as a resource as you prepare to file your taxes.

This information is intended to serve as one of many resources in your toolkit. It does not substitute for, nor should it be construed as personalized advice from a tax preparer.

State Relief Programs

Most state relief programs, including Wisconsin’s Child Care Counts Stabilization Payment Program, provide funding to cover costs you have already paid or will need to pay soon. Consequently, you must report the funds as income on your federal taxes in the year that you receive the payment. This means that the federal government will tax your grant money at your federal income tax rate. Because you will need to pay taxes on relief funds, your tax bill will most likely increase; however, this can be offset by claiming expenses paid for by the grant as a business deduction.

Let’s look into the upsides of relief funding in the tax process:

First, federal taxes on relief funds do not affect how greatly you are taxed on your earned income; the additional tax money you are paying is being taken out of the funds you received from the grant.

Second, expenses covered by the grant continue to qualify as a deduction. Let’s look at an example case.

Example:

Ashley was eligible for Wisconsin’s Child Care Counts Stabilization Payment Program and she received a total of $5,400 in support in 2022. Ashley allocates the money to her rent and utilities.

When Ashley does her 2022 taxes, she can still report rent and utilities as expenses — they qualify as eligible deductions. This means that Ashley is reducing her tax burden by deducting eligible expenses, even though those expenses were paid from relief funds rather than Ashley’s earned income.

Ashley’s 2022 earned income is $40,000. As a single filer in 2022, Ashley would owe the federal government $8,581.10 in taxes if she did not receive a grant.

However, Ashley needs to add the additional relief grant she received to her income. Ashley adds the $5,400 in relief funds to her taxable income.

Now, Ashley’s total income is $45,400. Since Ashley is in the 22% federal tax bracket, she is taxed an additional $380.82 on the $5,400 relief grant, which increases her federal tax bill from $8,581.10 to $8,961.92

Although Ashley’s federal tax bill did increase by $380.82, Ashley was able to directly put $5,019.18 of Wisconsin’s Child Care Counts Stabilization Payment Program funds toward her expenses. Ultimately, Ashley ended up with more money than she otherwise would have and was able to reduce her tax burden using relief-funded deductions. The receipt of Wisconsin’s Child Care Counts Stabilization Payment Program funds allowed Ashley to help her business and her family.

Paycheck Protection Program Loans for 2021 Filings

If you received a Paycheck Protection Program (PPP) loan in 2021, the federal tax implications are different. Neither the loan revenue nor forgiveness should be included on your federal tax return. The income and forgiveness on your PPP loan are not taxed and you can take the expenses as a deduction.

Employee Retention Tax Credit & Families First Coronavirus Response Act

You may have received the Employee Retention Tax Credit (ERTC) and/or the Families First Coronavirus Response Act (FFCRA) to help reimburse payroll expenses that you maintained while your business operations were impacted by the pandemic. Both the ERTC and FFCRA are refundable tax credits meant to offset wages that your business paid out.

Funds received from the credit(s) are taxable and will be included in your gross income for federal or state tax purposes. Please consult with your tax professional regarding these tax credits.

In-Kind Supplies

If you received in-kind gifts of tangible supplies (rather than money to buy the supplies), you most likely will not face a tax liability. Consult with your accountant or tax preparer to determine the best way to record the donation.

Economic Injury Disaster Loans & Other Small Business Administration Loans for 2021 Filings

The Economic Injury Disaster Loan (EIDL) provided funds to help businesses through the COVID-19 pandemic. The EIDL had two components.

First, the EIDL advanced a grant to the recipient of up to $10,000. This advance is not taxable and should not be included in your revenue on your taxes.

Second, the EIDL included an option for a loan. If you took on an EIDL loan, it is considered business debt. The debt is not deductible or taxable, but you can deduct your interest payments.

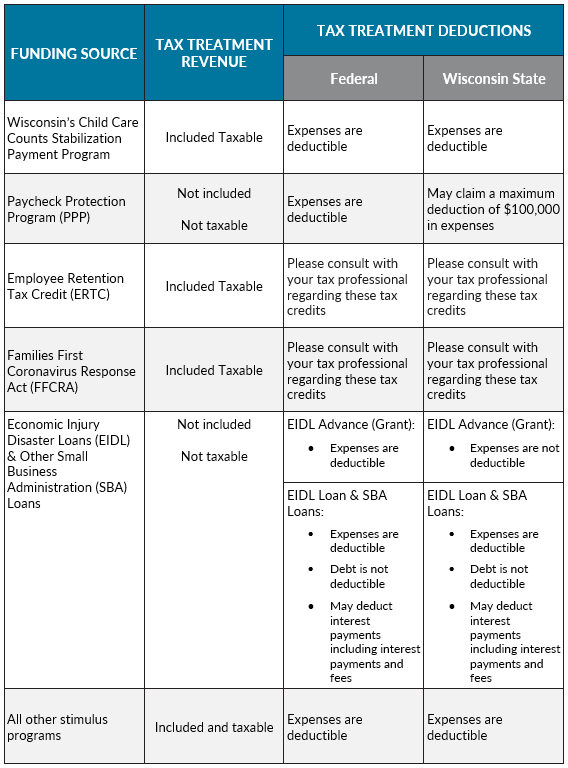

Tax Treatment by Funding Source

Getting Ready for Tax Time

If you received pandemic relief funds, it has likely been — and will continue to be — critical to your child care business’s financial operations and recovery. Even though this support can increase your tax liability, the new income that it offers you is valuable.

The best way to prepare for this taxation is to organize your expense documentation (receipts, payroll, etc.) and differentiate the sources of income used to pay for your potential deductions for federal vs. state purposes. This is because what you are allowed to deduct may vary for your federal vs. state tax filings. You should then set aside an amount of funds equal to your marginal tax rate so that you are prepared to pay any owed tax. If you are unsure, you can use 22%, which is the most common tax rate in the US. (To learn more about tax time, find additional resources here.)

Assistance is Available

For more early care and education resources, please visit the Wisconsin Early Childhood Association (WECA) website. If you are not a member of WEESSN, click here to learn about the business training and support it offers. Ready to join WEESSN? Click here!

Disclaimer

The information contained here has been prepared by Civitas Strategies Early Start and is not intended to constitute legal, tax, or financial advice. The review of your tax situation using the information contained within this guide is not a substitute for carefully selecting a qualified tax preparer and should not be used in place of legal or accounting advice when needed. The Civitas Strategies Early Start team has used reasonable efforts in collecting, preparing, and providing this information, but does not guarantee its accuracy, completeness, adequacy, or currency. The publication and distribution of this information is not intended to create, and receipt does not constitute, an attorney-client or any other advisory relationship. Reproduction of this information is expressly prohibited.

Developed January 2022, revised July 2022.