In this resource, we will explore current Tax Credit possibilities for your child care business and how you can find out more to apply.

What Tax Credits are Available for Group Center and Family Child Care Businesses?

As an individual and a small business owner, you are familiar with the tax system. As a child care business, you understand the necessity to maximize every dollar to put back into your program to improve the lives of children, your staff, and yourself so that you can continue to provide services that Wisconsin depends on.

You may have business goals such as offering staff benefits or performing home improvements to boost your program’s quality, but it may seem to you that these items are too expensive to be within your reach. In fact, there are tax credits that you can use as you implement certain benefits and improvements within your child care business. Tax credits are a useful tax savings tool as they offer dollar-for-dollar reductions in your tax liability. In this guide, we will discuss some key tax credits that child care businesses should be sure to explore.

Pandemic-related Tax Credits

The federal government offered tax credits for businesses that were impacted by the COVID-19 pandemic. The coverable period for the credits began March 13, 2020, and businesses can still claim them retroactively through 2024.

The Employee Retention Tax Credit (ERTC) allows eligible businesses that were impacted by the pandemic and continued to pay their W-2 employees to receive a credit of 50% in 2020 and 70% in 2021 for wages paid out to staff. The maximum credit for 2020 is $5,000 per employee and $21,000 per employee in 2021. Read our ERTC guide for more details on this valuable credit.

Families First Coronavirus Response Act (FFCRA) allows sole proprietors as well as businesses with W2 employees to receive reimbursement for paid sick leave that was offered to staff who were out for pandemic-related reasons. This also covers program closures due to COVID-19 exposures. Businesses can receive reimbursement for up to 40 hours of paid sick leave per person from March 13, 2020 – March 31, 2021, and up to 40 hours per person for April 1, 2021 – September 30, 2021. Read our FFCRA guide for more details on this valuable credit.

Tax Credits for offering Staff Benefits

Health Insurance

Small businesses can benefit from the Small Business Health Care Tax Credit which will reimburse you for half of your contributions toward your employee’s premiums as long as you cover at least 50% or more per employee. There are other guidelines that you must meet, which in most cases a typical small-to-midsize child care business would. For example, if an employee’s monthly premium is $235 and you pay 50% ($117.50), you would be eligible for a tax credit of $58.75. That translates to annual costs of $1,410 for you, and you would receive back $705 when you file your return.

For more information, visit the Small Business Health Options Program (SHOP) website. There, you can search for an example of starting costs for health care insurance plans based on your location.

In many Wisconsin localities, to enroll in SHOP, you will need to use a SHOP-registered agent or broker. Visit https://localhelp.healthcare.gov/ to search and find a local agent or broker. To find a navigator in your area, use the search feature at https://coveringwi.org/.

Pro-tip: Maximize your savings by claiming the Small Business Health Care tax credit and deducting your expenses for staff benefits!

Example: Happy Apple Child Care has a SHOP health plan that their employees participate in. Happy Apple pays at least 50% of their employee’s benefits, so they are eligible to receive the Small Business Health Care tax credit. Their costs total $2,500. They can receive a tax credit for half of their costs, $1,250. Additionally, they can deduct as a business expense, the full costs of the staff benefit they provide which is $2,500.

Retirement

Small businesses that start up a retirement plan can benefit from the Setting Every Community Up for Retirement Enhancement (SECURE) Act tax credit. Eligible employers may be able to claim a tax credit of up to $500 to $5,000, for three years, toward setup and administrative fees associated with starting a SEP, SIMPLE IRA, or 401(k) plan. Additionally, small businesses can earn another $500 tax credit by adding an automatic enrollment feature to a new or existing plan. Learn more here and be sure to talk with your tax professional about this tax credit opportunity.

Pro-tip: Maximize your savings by claiming the SECURE tax credit and deducting your expenses for staff benefits!

Example: Happy Apple Child Care has a 401(k) plan that their employees participate in. Happy Apple pays $2,000 in setup and administrative fees. It was determined that they are eligible to receive the SECURE tax credit for $500.

They also pay into their employee’s retirement plans and those costs total $2,500. Because it is a business expense, they can still deduct the costs of the staff retirement benefit they provide which is $2,500 but cannot include the setup fees for which they received the credit.

Paid Family and Medical Leave

Employers may claim the Employer Credit for Paid Family and Medical Leave (learn more here) which is equal to a percentage of wages they pay to qualifying employees while they’re on family and medical leave. This credit is available through 2025.

These are the qualified leaves:

Birth of an employee’s child and to care for the child.

Placement of a child with the employee for adoption or foster care.

To care for the employee’s spouse, child, or parent who has a serious health condition.

A serious health condition that makes the employee unable to perform the functions of his or her position.

Any qualifying situation due to an employee’s spouse, child, or parent being on covered active duty (or having been notified of an impending call or order to covered active duty) in the Armed Forces.

To care for a service member who is the employee’s spouse, child, parent, or next of kin.

The credit that the business receives is based on the percentage of wages that you pay the employee while on leave ranging from 12.5% to 25%. To learn more, click here.

Tax Credit for Hiring Staff that belongs to a Targeted Group

The Work Opportunity Tax Credit

Businesses can receive a tax credit for hiring staff that belong to specific targeted groups. Historically, those in the targeted groups have faced employment barriers and by employing them, you are helping to alleviate those barriers and contribute toward their economic stability. This credit is only for new hires, and you must request and receive certification that the person belongs to a targeted group.

Someone is a member of a targeted group if he or she began working for you before 2026 and is a:

Long-term family assistance recipient,

Qualified recipient of Temporary Assistance for Needy Families (TANF),

Qualified veteran,

Qualified formerly incarcerated people,

Designated community resident,

Vocational rehabilitation referral,

Summer youth employee,

Supplemental Nutrition Assistance Program (SNAP) benefits (food stamps) recipient,

SSI recipient, or

Qualified long-term unemployment recipient.

To qualify for the credit, you must complete Form 8850 and ETA Form 9061 or ETA Form 9062, which is the request for certification. There is a portion for you to complete and for the employee to complete. After you both sign the form, you will send the forms to the Department of Workforce Development either electronically in eWTOC or via mail by the 28th day following the hiring. The credit ranges from $1,200 to $9,600 depending on the target group the employee belongs to. For more information about this credit visit the WOTC website.

Tax Credits for Employer-Provided Child Care Facilities and Services

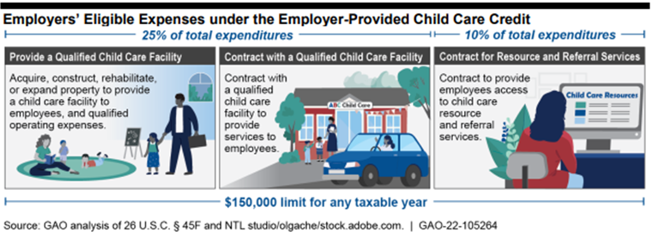

For 20 years, the federal government has offered a tax credit to encourage businesses to offer child care benefits to their employees. The Employer-Provided Child Care Facilities and Services credit allows businesses to receive a valuable tax credit of 25% of related child care expenses and 10% of their resource and referral expenses, up to a total of $150,000.

To be eligible for this credit, a business has the following options for offering employer-provided child care:

Providing On-Site Care for Employees: This includes expenses to acquire, construct, rehabilitate, or expand a property to provide child care to employees, as well as qualified operating expenses for such child care services.

Contract with a Child Care Program: Expenses in this category include those needed to contract with a qualified child care facility that will provide child care services to the children of employees. This can include existing state-funded partnership programs, such as WI Partner Up Program. Additionally, a child care provider that is offering free care to their employees that accounts for 30% or more of total enrollees would likely qualify.

Contracting for Research and Referral: This includes costs to contract with an entity that will provide research and referral services, to help employees find child care.

If a child care business seeks to claim this tax credit for service offered to its own employees, then at least 30% of enrolled children must be employees’ dependents. For example, if your child care program has 20 enrolled children, at least six children (30%) must be dependents of your employees for your business to be eligible to claim the credit.

Pro-tip: The availability of this credit could be a useful marketing tool for child care businesses that are seeking to grow their services. Share information about this credit with businesses that you would like to form a possible partnership with to offer care for their employees. It’s a win-win; the business is able to offer child care for their employees and you benefit from steady enrollment!

Here are some example scenarios of this beneficial tax credit:

Example 1, Contract with a Child Care Business:

Gadgets & Gizmos Corporation has a $50,000 annual contract with Happy Apple Child Care, an off-site child care program. Total qualified expenses for the Corporation will amount to the total incurred cost of their contract with Happy Apple Child Care: $50,000.

Additionally, Gadgets & Gizmos contracts with a local Child Care Resource & Referral agency (CCR&R) to connect employees to other options for child care programs in addition to Happy Apple Child Care. The Corporation’s annual contract with its local CCR&R is $10,000.

Gadgets & Gizmos incurred $50,000 in qualified child care services expenses; the business would receive a tax credit of up to $12,500. ($50,000 x 0.25 = $12,500)

Additionally, since 10% of resource and referral expenditures can be claimed, Gadgets & Gizmos can claim $1,000 ($10,000 x 0.1 = $1,000) as a tax credit for their CCR&R contract.

In total, Gadgets & Gizmos can claim $13,500 as an annual tax credit.

Example 2, Providing On-Site Care for Employees AND Contract with a Child Care Business:

Goodman LLC contracts with child care provider Little Learners to offer child care services at the Goodman LLC office building. Total qualified expenses for Goodman LLC can include costs of the on-site facility and the total incurred cost of Goodman LLC's contract with Little Learners.

Example 3, Providing On-Site Care for Employees (Business is already a licensed Child Care Provider):

Happy Apple Child Care is a licensed child care center that serves 50 children. Fifteen of the children enrolled are children or dependents of their employees. They meet the 30% enrollment requirement for an existing licensed child care facility and can claim the Employer-Provided Child Care Facilities and Services credit.

Their total operating expense for the year is $400,000 which is considered qualified child care services expenses. The business would receive a tax credit of up to $100,000. ($400,000 x 0.25 = $100,000).

Happy Apple can choose whether or not to offer a discount to their staff, understanding that their business would be able to recoup those discounts via the credit they will receive for classifying as employer-provided child care. The use of this credit can allow them to:

1. Receive additional revenue

2. Secure enrollments

3. Offer a child care staff benefit

4. Attract and retain staff

It’s important to note that any of these scenarios apply to any kind of child care provider whether it’s a family child care provider or a child care center.

Tax Credits for Home Owners (family child care providers)

NEW in 2022!

To support clean energy, the Inflation Reduction Act will extend and expand tax credits for certain energy-related home improvements. This may include energy-efficient:

Solar panels

Water heaters

Heat pumps

HVAC systems

Windows

Doors

Appliances

And more!

Starting in 2023, the Energy Efficient Home Improvement Credit will be equal to 30% of total energy-efficient improvement costs made throughout the year up to a maximum credit of $1,200.

The Residential Clean Energy Credit offers a 30% credit on the cost to install certain systems that use solar, wind, geothermal, biomass, or fuel cell power to power your home, heat water, or regulate the temperature in your home.

Updates are underway for this new tax law, continue to check Energy Star for guidelines and updates.

Additional Assistance

For more early care and education resources, please visit the Wisconsin Early Childhood Association (WECA). If you are not a member of WEESSN, click here to learn about the business training and support it offers. Ready to join WEESSN? Click here!

Disclaimer: The information contained here has been prepared by Civitas Strategies Early Start and is not intended to constitute legal, tax, or financial advice. The Civitas Strategies Early Start team has used reasonable efforts in collecting, preparing, and providing this information, but does not guarantee its accuracy, completeness, adequacy, or currency. The publication and distribution of this information is not intended to create, and receipt does not constitute, an attorney-client or any other advisory relationship. Reproduction of this information is expressly prohibited.